Financials

Clear Enterprise integrates all your financial activities into a single powerful control centrel

A complete financial picture of your business

Take control with the fully integrated General Ledger and achieve a complete financial picture of your business with automatic posting of transactions Accounts Payable, Accounts Receivable and Inventory sub-ledgers

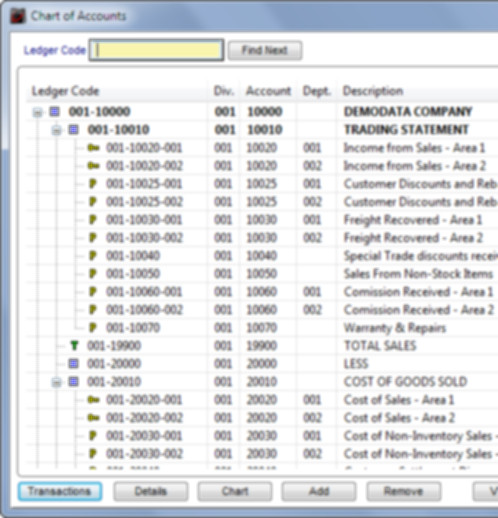

General Ledger

The general ledger is a flexible solution to manage the financial needs of many industries giving you the ability to manage multiple business entities within the organisation

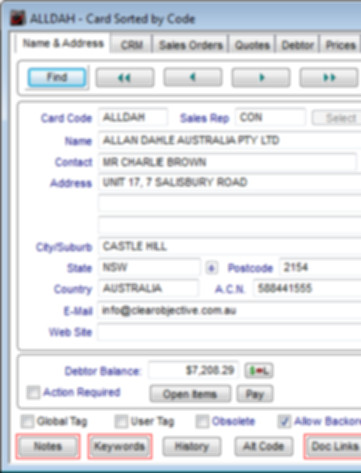

Accounts Receivable

Clear Enterprise Accounts Receivable manages accounts receivable functions from sales transactions all the way through to GL postings. Based on preset parameters, data entry staff require only minimal knowledge postings

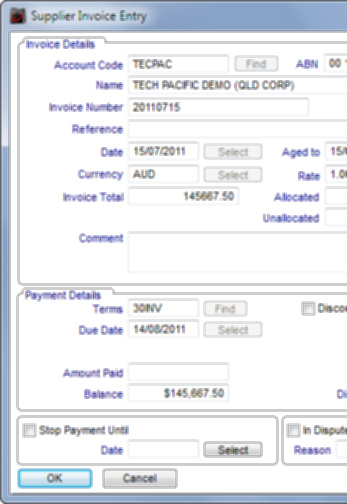

Accounts Payable

Total control of your supplier accounts with a full view of supplier contract pricing, transactions and bulk payments. Keep tabs on aged payables and keep suppliers advised with email notifications after payment runs

General Ledger

The Chart of Accounts provides the structure (divisions / departments / activity centres) for the ledger and individual accounts can be assigned account types that control their behaviour.

Divisions can be used to handle multiple business entities within the organisation, with optional consolidation. Departments can be defined for sections within the trading entity. Activity Codes allow an additional method of classification for reporting.

General Ledger Posting

Journals are automatically created in batches for transactions raised in the system, with a hierarchy of settings that determines the accounts to be used. General journals, standing journals and auto-reversing journals can be entered plus distributions allow automatic dissection of journals on a percentage basis.

Batch posting can be initiated manually or be scheduled to occur on a regular basis, with the option for consolidation during the posting process. Checks prevent unbalanced batches posting to the ledger and invalid entries can be edited subject to access permissions.

All ledger transactions are uniquely identified, giving full traceability over all financial years. For auditing purposes, full drill-down capabilities allow the original source documents to be viewed.

The financial year can be divided into 12 or 13 date-based periods, defaulting to the twelve calendar months with the year ending at any desired period.

Accounts Receivable

Clear Enterprise Accounts Receivable is an open item system with a full history retained for all debtor accounts, with drill-down capability to source transactions.

The centralised management of customers provides easy access to debtor accounts and all transactions, along with quick links to related processing areas. Default aging periods (30/60/90/120 days) may be changed to suit the business needs.

Each customer can have multiple associated contact names, locations and delivery addresses. The Debtor Account can be held in any currency and this may be different from the currency in which orders are placed.

Corporate account management is simplified through the establishment of Branch/Head Office relationships between customers.

Credit Control

Credit Control is facilitated by the use of credit limits, trading terms, transaction authorisation rules and customer on-hold status. Debtor statements can be easily prepared for a single customer, groups of customers or all customers.

Accounts Payable

Clear Enterprise Accounts Payable is an open item system with a full history retained for all creditor accounts, including drill-down to source transactions.

Centralised management of suppliers provides easy access to creditor accounts, all transactions plus quick links to the related processing areas. Each supplier may have multiple associated contact names and details.

The Creditor Account can be held in any currency and this may be different from the currency in which orders are placed. Corporate account management is simplified through the establishment of Branch/Head Office relationships between suppliers.

Creditor Payments

Payment management is facilitated through the use of account trading terms and payment priorities. Payments can be made against purchase orders or invoices and recipient-created invoices (RCTI) can be generated from payments against good receipts. Payments to creditors can be made through a variety of user-definable payment media.